Claim denials are one of the most frustrating challenges in healthcare billing. A single denial can set off a chain reaction delayed payments, increased AR days, extra administrative work, and revenue loss. Many practices find themselves constantly putting out fires, trying to figure out why claims were denied and how to fix them.

The reality is, claim denials aren’t just occasional hiccups they’re a systemic issue. According to the Industry reporting, the average denial rate across practices ranges from 5–10%, and resolving each denial can take up to 20 minutes or more. For larger practices, that adds up to hundreds of hours each month spent on rework instead of patient care.

Reducing claim denials requires more than just checking boxes; it’s about intelligent, proactive revenue cycle strategies. With AI-driven denials management and a structured roadmap, practices can minimize denials, protect revenue, and create more predictable cash flow.

In this blog, we’ll explore:

- Why denials are so common and the impact on practices

- Key strategies to reduce claim denials in 2026

- How AI and automation are transforming denials management

- Real-world examples of success in healthcare settings

- How Claimity supports practices in achieving revenue protection

Why Claim Denials Are Still a Major Challenge

Before diving into solutions, it’s important to understand why denials happen. Claim denials typically stem from:

- Eligibility and coverage issues – Claims submitted for patients whose insurance information is outdated or incomplete are often denied.

- Coding errors – Incorrect CPT, ICD-10, or modifier codes can trigger denials.

- Incomplete or missing documentation – Payers often require specific clinical documentation to approve claims.

- Payer-specific rules – Each insurance provider has unique requirements that staff may not always know or follow.

- Timeliness – Claims submitted after payer deadlines or without prior authorization can be rejected.

These issues create administrative bottlenecks, slowing payments and increasing AR days. Beyond financial impact, they also frustrate staff and can indirectly affect patient satisfaction, especially if delays affect treatment timelines.

The Cost of Denials

Denials are more than an administrative headache they have real financial consequences:

- Revenue loss: Each denied claim increases write-offs if not corrected promptly.

- Higher administrative cost: Staff spend hours correcting denials and resubmitting claims.

- Extended AR days: Delays in payment reduce working capital for operations and investments.

- Patient dissatisfaction: Delays in approvals for procedures or therapies can frustrate patients.

Research indicates that healthcare organizations lose up to 5% of annual revenue due to avoidable denials, highlighting the need for a proactive approach to denials management.

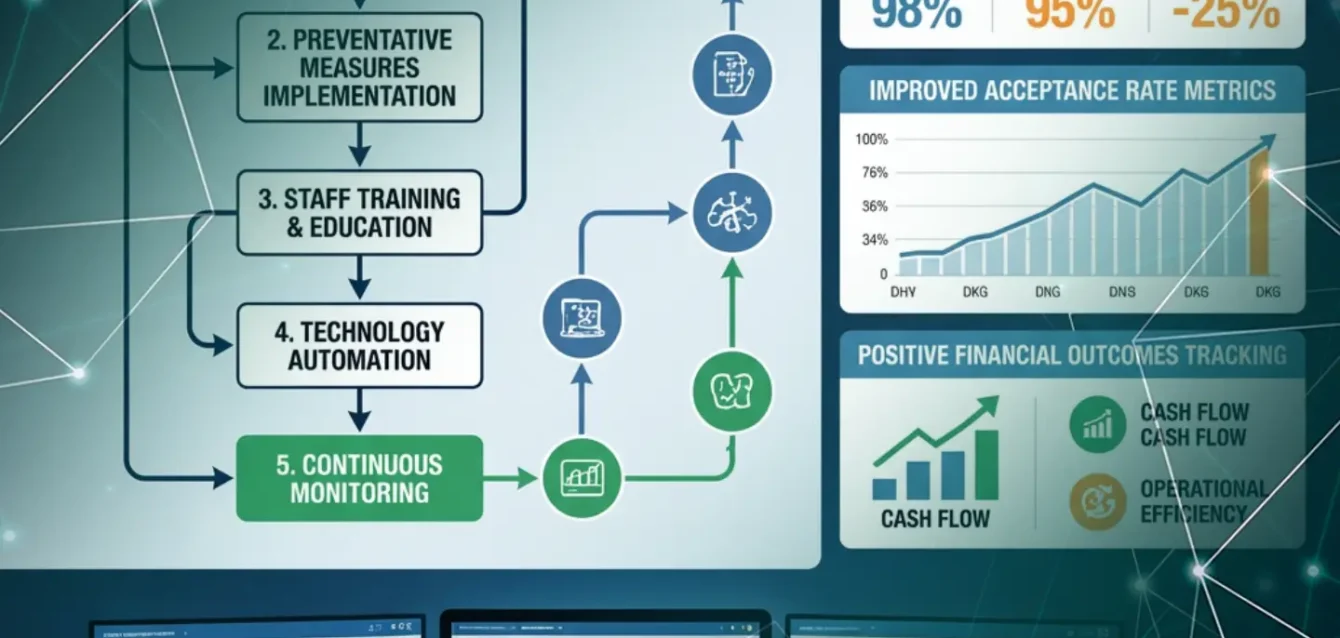

A Roadmap to Reducing Claim Denials in 2026

Reducing claim denials requires a structured, multi-pronged approach. Here’s a roadmap that practices can follow:

1. Start with Accurate Patient Data

Ensuring accurate patient information is foundational. Practices should:

- Verify insurance eligibility at the point of scheduling

- Collect up-to-date patient demographics and insurance details

- Use automated systems to flag missing or outdated information

Accurate patient data prevents the most common denial types, including eligibility and coverage errors.

2. Optimize Coding and Documentation

Coding errors are a major contributor to denials. To reduce errors:

- Train staff on proper CPT, ICD-10, and modifier coding

- Use AI or software tools to flag potential coding mistakes before submission

- Ensure clinical documentation is thorough, clear, and aligned with payer requirements

This reduces denials caused by incorrect or incomplete claims and increases first-pass acceptance rates.

3. Implement Real-Time Eligibility and Benefits Verification

Manual verification can be time-consuming and error-prone. Practices can:

- Use AI-powered verification to check patient coverage instantly

- Flag any missing authorizations before the claim is submitted

- Integrate eligibility checks into the EHR workflow for seamless operations

Real-time verification ensures claims are submitted with the correct coverage details, preventing avoidable denials.

4. Use Denials Analytics to Identify Patterns

Not all denials are random. Practices should analyze trends to target root causes:

- Track denial types by payer, provider, and procedure

- Identify recurring errors or process gaps

- Create action plans to address systemic issues rather than just fixing individual claims

By using analytics, teams move from reactive rework to proactive prevention.

5. Prioritize High-Impact Claims

Not every denial has the same financial impact. Practices should:

- Identify high-value claims or frequently denied procedures

- Focus resources on resolving claims with the biggest revenue risk

- Use AI-driven prioritization to automate workflows and reduce manual effort

This ensures that the practice’s time and effort are aligned with revenue protection.

6. Automate Denial Prevention and Resolution

Automation is a game-changer in modern revenue cycle management:

- AI can analyze claims in real time, flagging potential errors before submission

- Automated workflows can suggest corrections or generate appeal-ready documentation

- Historical data can predict denial likelihood, allowing proactive intervention

Automation reduces human error, accelerates claim processing, and improves financial outcomes.

7. Educate and Align Your Team

Even the best tools fail without skilled users. Practices should:

- Conduct regular training on billing, coding, and payer-specific rules

- Foster communication between clinical and billing teams

- Encourage staff to share insights on common denial causes

A knowledgeable and coordinated team reduces errors at every step.

8. Monitor Performance Continuously

Revenue cycle optimization is ongoing. Practices should:

- Track first-pass acceptance rates, denial trends, and AR days

- Use dashboards and reports to monitor improvement

- Adjust processes in real time based on data insights

Continuous monitoring ensures long-term success and sustainable revenue protection.

How AI is Transforming Denials Management

AI plays a pivotal role in reducing claim denials by:

- Automating data validation: AI scans claims for errors before submission

- Predicting denial risk: Historical data helps forecast claims likely to be denied

- Optimizing workflow: AI integrates into EHR and billing systems for real-time interventions

- Enhancing analytics: AI dashboards reveal patterns that humans might miss

With AI, practices can focus on strategic revenue protection rather than firefighting day-to-day denials.

Real-World Examples of AI-Driven Denial Reduction

Radiology

- AI scans imaging claims for missing documentation and coding errors

- Predictive analytics highlight high-risk claims before submission

- Result: fewer resubmissions, faster reimbursements

Oncology

- Cancer treatments require precise authorization and documentation

- AI identifies potential denials and generates appeal-ready reports automatically

- Result: more predictable cash flow and reduced administrative burden

Orthopedics

- Surgical claims are often complex and prone to coding mistakes

- AI validates codes and documentation before submission

- Result: improved first-pass acceptance and reduced AR days

These examples show that AI-powered denials management works across specialties, streamlining revenue cycle operations and protecting revenue.

The Claimity Advantage in Denials Management

Claimity’s AI-powered solutions are designed for comprehensive revenue protection:

- Real-time claims validation: Catch errors before submission

- Predictive denial insights: Identify at-risk claims early

- Automation and workflow integration: Reduce manual effort and improve accuracy

- Analytics dashboards: Monitor denial trends, AR days, and cash flow

- Compliance: Adheres to HIPAA, CMS, and payer-specific requirements

Claimity helps practices move from reactive denial management to proactive revenue cycle optimization, ensuring financial stability and efficiency.

Final Thoughts: Turning Denials into Revenue Opportunities

Claim denials don’t have to be a constant drain on your practice’s resources. With a structured roadmap, intelligent analytics, and AI-powered tools like Claimity, practices can reduce claim denials, protect revenue, and improve financial performance.

2026 is the year to shift from reactive denial management to proactive revenue cycle optimization. Every denied claim avoided is time, money, and effort saved and more predictability in cash flow, better operational efficiency, and improved patient care.

With Claimity, practices gain the tools, insights, and automation needed to navigate complex payer rules, reduce denials, and keep revenue on track.

FAQs: Reducing Claim Denials in 2026

Common causes include eligibility issues, coding errors, missing documentation, payer-specific rules, and late submissions.

AI validates claims in real time, predicts denial risk, automates workflow, and provides actionable insights for faster, cleaner submissions.

Practices often see a 30–50% reduction in denials, faster reimbursements, reduced AR days, and improved cash flow.

Yes. Claimity integrates seamlessly with major EHR and billing systems, making adoption smooth and minimizing workflow disruption.

By tracking trends, analyzing denial patterns, training staff, and leveraging AI insights, practices can proactively prevent denials and optimize revenue cycles.